EU sustainable finance reforms give an enjoyable prospect for asset professionals

A seismic industry change in state of mind and behaviour, alongside new law and regulation, is driving an evolution of Environmental, Social and Governance techniques, with ESG cash anticipated to a lot more than triple in asset size by 2025 and maximize their share of the European fund sector from 15 to 57% (PwC investigation, described in the FT).

The EU has released a package of sustainable finance reforms that affect EU companies and these seeking to do business in the EU. The Disclosure Regulation and Taxonomy Regulation equally implement to “financial current market participants”, like AIFMs, UCITS ManCos and MiFID investment corporations supplying portfolio management suggestions. Since of the scope and application of the proposed regulations that surround these two important measures, it is also predicted that supervisors who are (or who take care of funds) exterior the EU will also will need to comply with numerous of the actions if they would like to current market their products to EU buyers. To assistance accomplish sleek implementation of the new rules throughout their organisations and merchandise, we would spotlight a few key action and realistic details for asset administrators.

- A scoping workout: There are greater disclosure and other obligations for individuals companies that have a sustainability aim as aspect of their business. This features corporations possessing to differentiate amongst their internet marketing of “Article 8” products (that endorse environmental and/or social features) and “Article 9” items (that have a sustainable financial commitment goal). In addition, corporations that are categorised as “large” will have to comply previously than many others (in June 2021).

- A strategic strategy: The extent that a firm incorporates ESG into its providers will form its technique, although making sure that governance, coverage and chance troubles are taken into account. For case in point, Report 8 and 9 products and solutions that are in just scope of the Taxonomy Regulation (ie they contribute substantially to a single or additional of the Regulation’s 6 Environmental Objectives) will need to make supplemental disclosures, comply with selected safeguards and affirm the “do no significant harm” basic principle applies to people investments that choose into account sustainable economic pursuits.

- A holistic tactic: Corporations will want to combine other sustainability specifications (as may well be prescribed under AIFMD, MiFID II, UCITS Directive, Insurance policy Distribution Directive and Solvency II) with sector most effective practices as may possibly be applicable on a sectoral level. For case in point, MiFID firms are expected to combine sustainability preferences into the solution oversight and governance approach. Expenditure advisers and discretionary supervisors will also be essential to inquire shoppers about their ESG preferences during the suitability assessment which is expected to generate larger curiosity in sustainable merchandise. AIFMs are to make sure that sustainability pitfalls and sustainability components are integrated in just their organisational, functioning, risk administration and due diligence procedures.

- A resilient method: The principal rules underneath the Disclosure Regulation arrive into impact on 10 March 2021, albeit that the publication of and compliance with the closing Amount 2 steps has been delayed (with 1 January 2022 becoming the anticipated new compliance deadline for the first set of RTS). This is probably to consequence in a two-tier approach and obtaining to re-visit disclosures and other obligations the moment the Stage 2 steps are finalised. One more challenge for Uk corporations impacted is to what extent the “in-flight” laws will implement at the conclude of the transitional period. In our watch, it looks unlikely that the British isles will want to materially diverge its rules with these of the EU, and at least want to be ready to aid organization continuity for cross-border fund operations. Last but not least, the deficiency of any grandfathering at the second means that firms will will need to assess and classify present resources/products as nicely as people becoming produced.

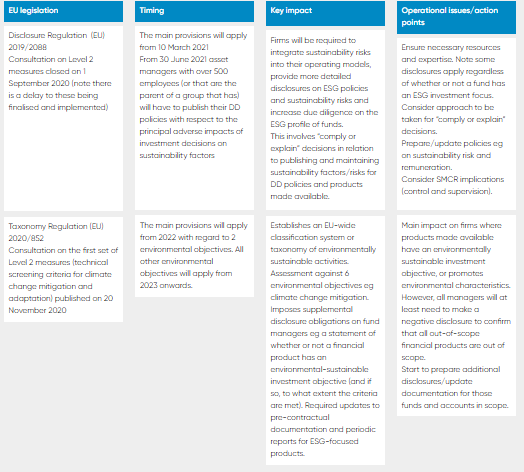

The desk below sets out the broad software and important impacts of the primary EU legislative offer (we have not integrated any specifics on the proposed delegated acts that integrate sustainability specifications into other directives). We also mentioned the proposals and specially how they effects asset supervisors in the course of our Rising Themes webinar on 26 January 2021.

We expect the latest COVID-19 disaster to increase the urgency of troubles that need to be addressed, and carry a renewed emphasis on social and governance issues – for instance, in phrases of how organizations treat their staff, suppliers and interact with their communities, as perfectly as recovery funding getting connected to obtaining social excellent.

THE UK’S Approach:

Nikhil Rathi, the FCA’s CEO, spoke at a Environmentally friendly Horizon Summit in November 2020 about the FCA deepening its sustainable finance tactic in order to drive greatest exercise and aid the changeover to web zero, and the great importance of collaboration with other regulators, the Federal government and marketplace to attain this. We would attract out a few themes which give handy markers for the UK’s expected technique in this region. 1st, the FCA has extended and accelerated its plans to introduce necessary local weather-linked financial disclosure necessities for shown issuers and massive asset owners that are aligned to the Taskforce on Local weather-associated Economic Disclosures’ (TCFD) suggestions. For asset managers, alongside with life insurers and FCA-regulated pension providers in the British isles, the FCA intends to seek advice from in the to start with half of 2021 on proposed new disclosure regulations. The TCFD’s Taskforce Roadmap expects 75% of asset supervisors to be included by the regulatory/legislative needs for TCFD reporting in 2022, raising to 96% by 2023.

Secondly, the Govt has announced its have Uk taxonomy for pinpointing which functions can be outlined as environmentally sustainable, and that this will take the scientific metrics in the EU taxonomy as its foundation. Thirdly, whist referring to “interactions with linked intercontinental initiatives, like these that derive from the EU’s Sustainable Finance Motion Plan” a single could effortlessly infer that the Uk has far more formidable regulatory and sector targets than the EU in this room.

Summary

Our view is that these ESG developments offer an thrilling chance for asset managers across all asset classes and sectors – whose steps can unlock financial commitment prospects and have tangible effects on economic prosperity and the health and fitness and wellbeing of stakeholders.

Even though not without problem, embracing sustainable expense ideal practices, together with implementation of the regulatory initiatives, will aid travel scrutiny of investment decision items and stay away from possibly problematic business and regulatory outcomes of greenwashing and misleading solution labelling.