BOE Passes On Opportunity to Confront a Surge in Bond Yields

(Bloomberg) — The Lender of England shipped a slightly more upbeat assessment of the U.K. economic system, sidestepping an option to interesting a surge a marketplace desire premiums.

The central bank’s Financial Coverage Committee left the speed of its stimulus unchanged as expected, noting economic output fell considerably less than expected in January whilst governments in the U.K. and U.S. the two outlined programs for new shelling out. Minutes of the assembly described “upside” dangers seven moments, up from two in February.

The conclusion indicated that the BOE led by Governor Andrew Bailey is tolerating a surge in bond yields about the globe, seeing it as a reflection that the economic mood is enhancing. That matched the U.S. Federal Reserve’s stance and stood in sharp distinction with the European Central Lender, which past 7 days moved to curb the marketplace shift with a pledge to stage up the speed of asset buys.

“The financial institution looks rather comfy with the plan that the current market moves reflect an bettering development and inflation outlook instead than an adverse and unwanted tightening in money problems,” stated Luke Bartholomew, senior economist at Aberdeen Common Investments.

Bonds have fallen in latest weeks, pushing up yields, on speculation that more powerful financial progress will thrust up inflation.

The generate on 10-calendar year gilts remained near a one-yr large at about .88% soon after the BOE assertion. Although borrowing fees remain close to historic lows, they’re now much more than four periods the ranges found at the get started of the 12 months.

The central lender reaffirmed its target for asset buys of 895 billion lbs . ($1.2 trillion) and preserved the weekly pace of its stimulus program. It remaining the important lending rate at a history small of .1%.

The MPC explained that all round economical conditions are “broadly unchanged” considering that February, describing costs of risky belongings as “resilient” and noting an enhance in the worth of the pound.

What Bloomberg Economics Suggests…

“The minutes of the Lender of England’s March assembly did minimal to recommend any alarm about the modern increase in bond yields. Continue to, it offered a reminder to traders that it is prepared to loosen once again if the restoration disappoints and there’s a larger-than-typical bar for tightening plan.”

— Dan Hanson, senior economist. Click listed here for complete React.

A report from the bank’s regional agents also confirmed signs of shopper demand from customers re-emerging. Even though revenue of apparel and cars were weak, athletics and leisure merchandise had been selling strongly together with out of doors furnishings and gardening products. The bank’s contacts said there is been a sturdy pickup in domestic vacation bookings. Manufacturing output remained weaker, but most hope an improvement in the up coming calendar year.

The sunnier tone adds to evidence that the BOE’s will very likely update its forecast for the financial system significantly in May well.

However, policy makers reported the outlook for the economy remains “unusually uncertain” and that the MPC was prepared to act both by tightening or loosening coverage.

They joined the Fed and ECB in offering assurances that there’s few symptoms nonetheless of a will need to tightening of policy, reiterating that they experienced no intention to transfer with no looking at evidence that a recovery is both equally absorbing excessive slack in the labor market place and major to a sustained increase in inflation.

Most economists really do not expect that to take place at any time quickly. One particular notable exception is the BOE Main Economist Andy Haldane, who has warned about inflation, expressing a “tiger has been stirred” that might “prove challenging to tame.”

His watch is backed by a operate of very good news on the economic system in new weeks, pushed by Prime Minister Boris Johnson’s swift vaccination software, which may well allow for most coronavirus principles to lapse by the finish of June. Chancellor of the Exchequer Rishi Sunak also prolonged a tax holiday on housing buys and benefits to furloughed staff in his finances before this month, which economists say will hold down unemployment.

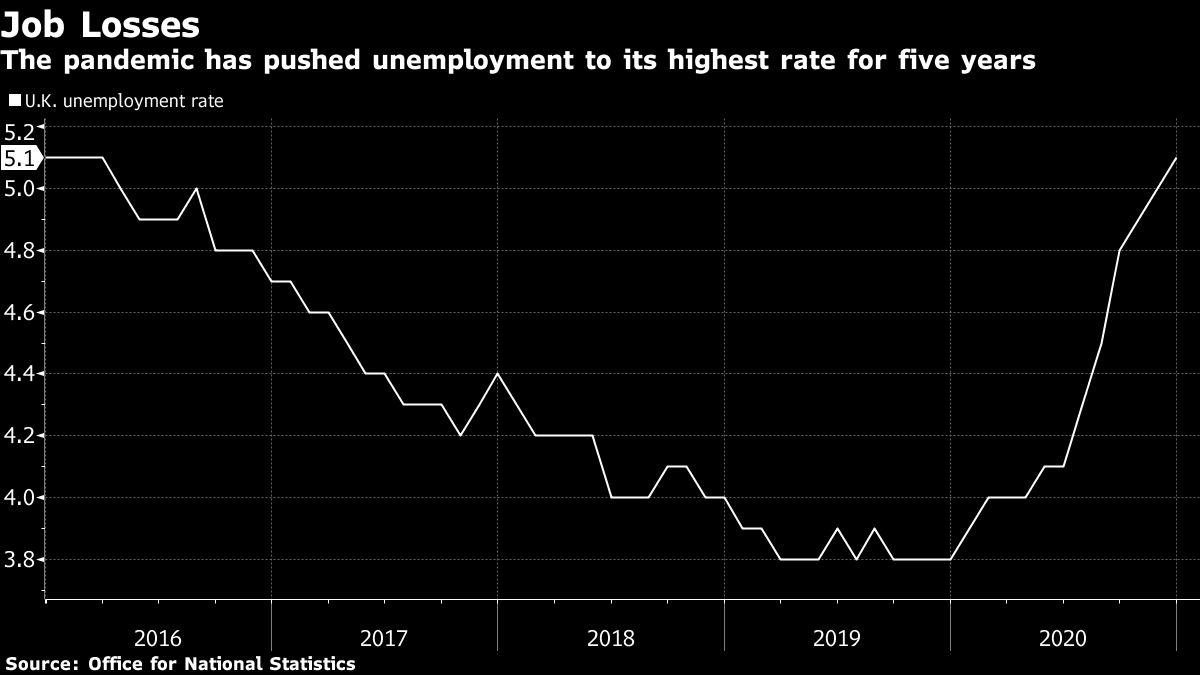

There’s sizeable risks much too. Though the latest extension of the furlough program will limit financial scarring, it will still leave unemployment significantly better in comparison with the pre-pandemic a long time.

Britain’s article-Brexit marriage with the EU could be an additional drag on progress prospective clients. U.K.’s trade with the bloc plunged in the initial entire thirty day period immediately after it left the common customs space.

“There was a vary of sights across MPC customers on the degree of spare capacity in the financial system at this time, whether demand from customers would outstrip offer throughout the restoration from the pandemic,” the BOE reported in its statement.

(Updates with depth from assertion.)

For more articles like this, be sure to stop by us at bloomberg.com

Subscribe now to continue to be in advance with the most dependable enterprise information source.

©2021 Bloomberg L.P.