New small business types, big opportunity: Monetary solutions

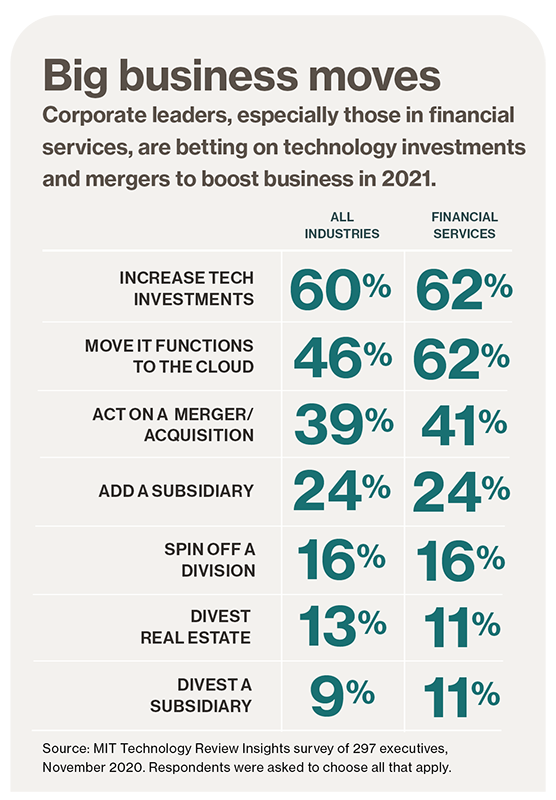

Additional determined than ever, organizations in all industries are ready to reduce charges that deficiency a distinct return on financial commitment. So it is no surprise that study respondents spotlight computing projects—all highly measurable— as priorities in their 2021 designs. Amongst financial expert services establishments, 62% are looking to ramp up tech investments, and another 62% be expecting to shift IT and organization capabilities to the cloud, in comparison with 46% throughout industries. In a new report, Nucleus Investigate identified that cloud deployments produce 4 instances the return on investment as on-premises deployments do.

Arranging beyond the pandemic

The Guardian Existence Insurance Corporation of The us is an exemplar of a progressive cloud adopter—it’s now transferring many of its main economic methods to the cloud. The insurance company was enthusiastic to do so—an interior examine had located numerous options, which includes insufficient information administration, a require for reduce-stage knowledge for much better analytics, a absence of method integration, and guide reconciliation troubles. “These agony details served produce the have to have for a new technique,” suggests Marcel Esqueu, assistant vice president for monetary methods transformation at Guardian. “We looked at shifting to the cloud about 5 several years ago, but we did not feel it was prepared.” Now the business deems cloud solutions mature adequate to assist the innovative operation it needs.

Money establishments are also wanting at mergers and acquisitions as a route over and above pandemic survival. In point, according to a Reuters report, these discounts were being up 80% in July, August, and September 2020 from the prior fiscal quarter to strike a whopping $1 trillion in transactions. In the MIT Technological innovation Assessment Insights survey, 41% of monetary products and services execs report that their corporations acted on a company merger or acquisition or will do so more than the coming year.

“People have recognized they will need to consolidate to produce more robust and far better-geared up businesses to deal with what the earth seems to be like likely ahead,” claims Alison Harding-Jones, running director at Citigroup, in the Reuters report.

Mergers and acquisitions have extensive been a way for an business to extend its core business—or even achieve expertise in emerging technologies. For illustration, though numerous money institutions get business enterprise software package with developed-in synthetic intelligence (AI) capabilities, Mastercard obtained a Canadian AI system enterprise referred to as Brighterion in 2017 to offer “mission-essential intelligence from any facts resource,” says Gautam Aggarwal, regional chief technological know-how officer (CTO) at Mastercard Asia-Pacific. The enterprise very first applied Brighterion’s know-how for fraud detection but now places it to get the job done in credit history scoring, anti-cash laundering, and the company’s marketing and advertising initiatives. “We’ve definitely taken Brighterion and used it not just for the payment use scenario but outside of,” claims Aggarwal.

Business adjust, exterior and in

Without a doubt, corporations have experienced to innovate and respond speedy to endure in the covid financial system. In the survey, 81% of organizations throughout industries have evaluated new organization products in 2020 or are preparing to start them over the future 12 months. Amid fiscal solutions establishments, bettering the customer encounter is paramount, with 55% reporting that they’re improving the knowledge they give their clients, as opposed with 35% throughout industries.

Which is true for Jimmy Ng, team chief information and facts officer (CIO) at Singapore-primarily based DBS Lender. When bodily branches shut during lockdowns, DBS customers— like other lender patrons the environment over—did their banking on-line. But some of them did so only for the reason that they experienced to. “The problem is irrespective of whether this group of persons will proceed being on the digital channel.” So DBS is checking out methods to maintain buyers who want in-person service engaged, exploring technologies these types of as augmented and digital truth and the 5G mobile network, which allows superfast connections. “How do we permit a joyful customer journey in this distant way of engagement?”

Down load the total report

This material was made by Insights, the custom articles arm of MIT Know-how Evaluation. It was not penned by MIT Engineering Review’s editorial staff members.