There is an Opportunity Brewing in Roku Inventory, Claims Wedbush

Considering the fact that peaking in mid-February, shares of Roku (ROKU) have retreated by 28%. Pullbacks amongst expansion-oriented stocks have been a popular concept this 12 months. Sector rotation, inflation fears and worries of overstretched valuations have all been cited as causes for the decrease among earlier substantial-flyers.

Nonetheless, even though Roku inventory was an trader most loved past calendar year and benefitted from the shift hastened by Covid-19 from linear Tv to related Television set (CTV), the acceleration is one that is set to continue on in the post-pandemic planet.

As such, Wedbush’ Michael Pachter tells investors it’s time to adhere to a person of the standard tenets in the investing rule reserve.

“While Roku’s share value is most likely to continue being unstable as anticipations are large in opposition to a wealthy valuation,” the analyst mentioned, “We believe the current pullback gives an interesting entry-issue.”

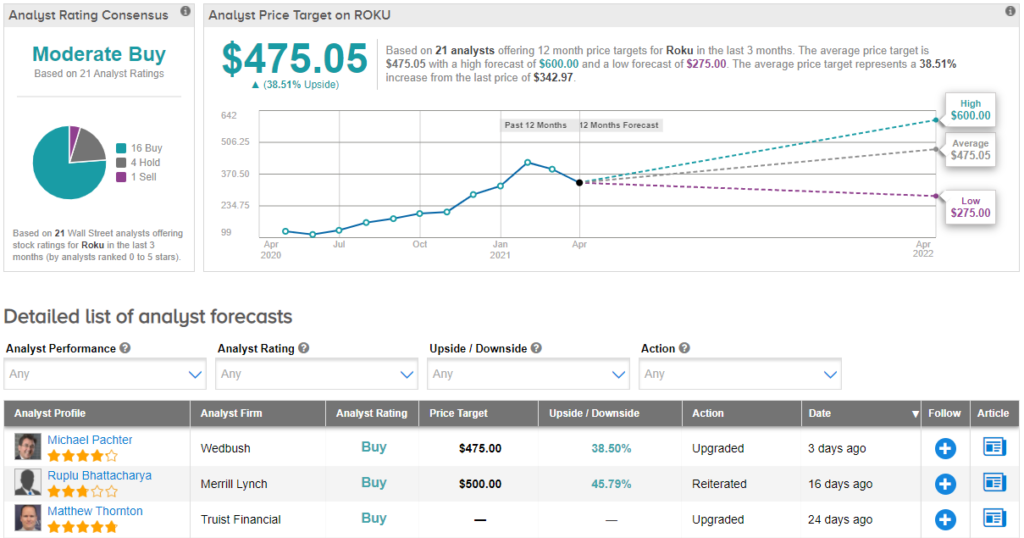

Appropriately, Pachter upgraded Roku’s score from Neutral (i.e., Keep) to Outperform (i.e., Buy). The $475 value concentrate on remains as is, suggesting upside of 38% more than the coming months. (To watch Pachter’s observe report, click on below)

Pachter’s advice arrives ahead of Roku’s 1Q21 earnings, which the business will report on Thursday (Could 6 AMC).

Pachter expects Q1 income of $493 million – proper at the superior conclusion of Roku’s steering of in between $478 and $493 million – and larger than the Street’s $491 million estimate. For the bottom-line, Pachter forecasts EPS of $(.13), when consensus has $(.15). “Our estimate indicates that we anticipate web revenue will come in at the significant-conclude of its direction for $(23) – (16) million),” Pachter observed.

Wanting deeper into FY21, the analyst anticipates “continued progress,” although notes there could be “moderate deceleration in 2H specified hard comparisons” to previous year’s Covid-driven giant strides ahead.

That reported, with the large picture in thoughts, Pachter thinks the simple fact that most marketing however normally takes location on linear Tv set and will retain on heading in Roku’s route usually means the pace of development is “sustainable.” Additionally, Roku is only in the to start with innings of global enlargement, which ought to gas extra progress more than the coming decades.

So, that is the Wedbush look at, what does the rest of the Road have in brain for Roku? Most of Pachter’s colleagues agree. Based on 15 Buys vs. 4 Retains and 1 lone Promote, the inventory has a Reasonable Get consensus score. The common price tag goal is only a bit better than Pachter’s, and at $476.95, implies shares will value by 39% in the yr forward. (See Roku stock assessment on TipRanks)

To come across very good ideas for shares buying and selling at desirable valuations, check out TipRanks’ Very best Shares to Buy, a freshly released instrument that unites all of TipRanks’ equity insights.

Disclaimer: The views expressed in this posting are exclusively these of the featured analyst. The written content is meant to be used for informational reasons only. It is very essential to do your have assessment just before generating any financial investment.