There’s a Quick-Time period Prospect in Ford Stock, Claims Analyst

Ford (F) is a legacy auto maker, with none of the glitz connected to the new electric powered automobile players. Even so, so far, this calendar year it is offering the upstarts a operate for their cash wherever market place overall performance is worried.

Shares are up 31% so far this thirty day period, 15% of which, the car large accrued in excess of the earlier two trading sessions. The uptick arrived after Deutsche Bank analyst Emmanuel Rosner issued a Catalyst Get in touch with on the inventory, recommending it as a brief-expression investing opportunity.

“We feel a strong products cycle, favorable pricing surroundings for US vans, improved warranty overall performance, and restructuring financial savings could consequence in better-than-expected 2021 advice, and prompt buyers to anticipate a much more intense turnaround trajectory,” the analyst explained.

Rosner expects Ford to publish remarkably good assistance when it reviews 4Q20 earnings on February 4. For 2021, Rosner is anticipating Ebit of $7.5 billion and EPS of $1.20, which is over consensus phone calls for $6.8 billion and $1.00, respectively. The analyst thinks “management could guide Ebit/EPS nicely previously mentioned $7bn/$1.00.”

Rosner states an desirable new item launch cycle, which includes new F-collection, Bronco and Mach-E designs, is just around the corner, and could likely “boost volumes and charges,” while the company’s “aggressive” efforts in South The united states could “garner restructuring personal savings.”

Also, subsequent several years of botched management, which have resulted in ballooning warranty fees – for the to start with 9 months of 2020, Ford’s were being a lot more than $2 billion larger than GM’s – the organization is “well positioned to flex down guarantee expense.”

“These tailwinds,” Rosner notes, “Should a lot more than offset the unfavorable impact from increased commodity costs.”

However, the Catalyst Connect with does involve some hazards together with “lower-than-anticipated 2021 assistance, challenges with execution on new product launches and a disappointing concept at its CMD (Cash Markets Working day).”

When the analyst notes the near-expression opportunity, for a longer period-expression, nonetheless, Rosner’s ranking stays a Maintain, “pending operational execution, and clarity about Ford’s EV method and positioning.” (To view Rosner’s monitor file, simply click listed here)

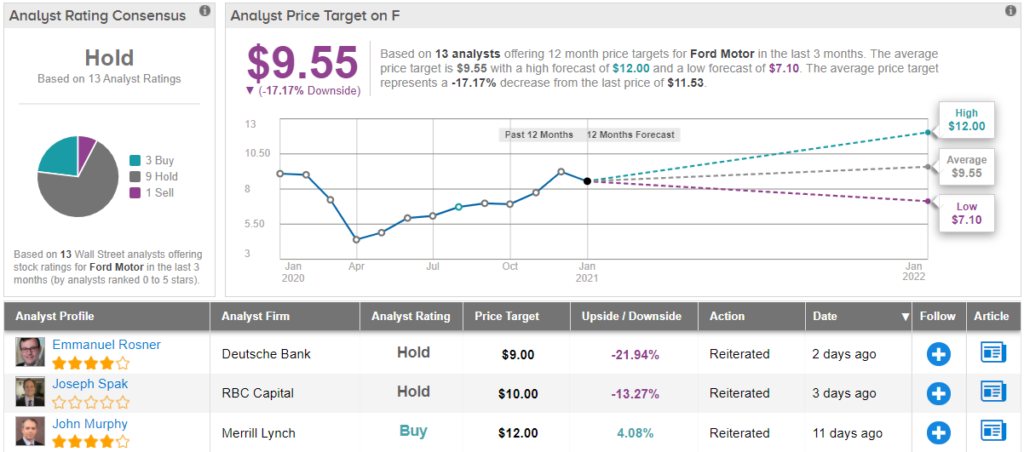

According to the analyst consensus, the inventory remains a Keep. The ranking is primarily based on 3 Buys, 9 Holds and 1 Promote. According to the forecast, the projection is for 17% downside, specified the regular selling price target at this time stands at $9.55. (See Ford inventory investigation on TipRanks)

To obtain excellent suggestions for shares buying and selling at desirable valuations, visit TipRanks’ Very best Stocks to Purchase, a freshly released resource that unites all of TipRanks’ fairness insights.

Disclaimer: The views expressed in this report are solely individuals of the featured analyst. The written content is supposed to be utilized for informational purposes only. It is really vital to do your have evaluation before producing any investment decision.